941 Quarterly Tax Form

IRS Tax Form 941: Instructions for Businesses for 2023

As the tax season approaches, businesses are reminded of their obligation to reconcile and report employee taxes through the IRS 941 quarterly form for 2023. This critical document serves as a record of withheld income taxes and Social Security and Medicare taxes from employees' paychecks. It's paramount for business owners and payroll specialists to understand the weight of ensuring accuracy on this form to avoid penalties and remain in compliance with federal regulations.

The 941 Tax Form Purpose & Terms of Use

Understanding the 941 quarterly tax return form is essential for all employers. This form stands as a summary of the taxes collected from employees, including federal income tax and both the employee and employer portions of Social Security and Medicare taxes. Given its complexity, it is crucial to be meticulous when preparing this document, as errors can lead to complications with the IRS.

Understanding the 941 quarterly tax return form is essential for all employers. This form stands as a summary of the taxes collected from employees, including federal income tax and both the employee and employer portions of Social Security and Medicare taxes. Given its complexity, it is crucial to be meticulous when preparing this document, as errors can lead to complications with the IRS.

When it comes to scheduling this crucial task, it is important to note that employers must file the 941 quarterly report form by the end of the month that follows the end of a quarter. To keep up with these deadlines, businesses can set calendar reminders or employ tax software that alerts them to upcoming filing dates. Additionally, preparing the pertinent payroll information in advance is wise to streamline filing when the deadline approaches.

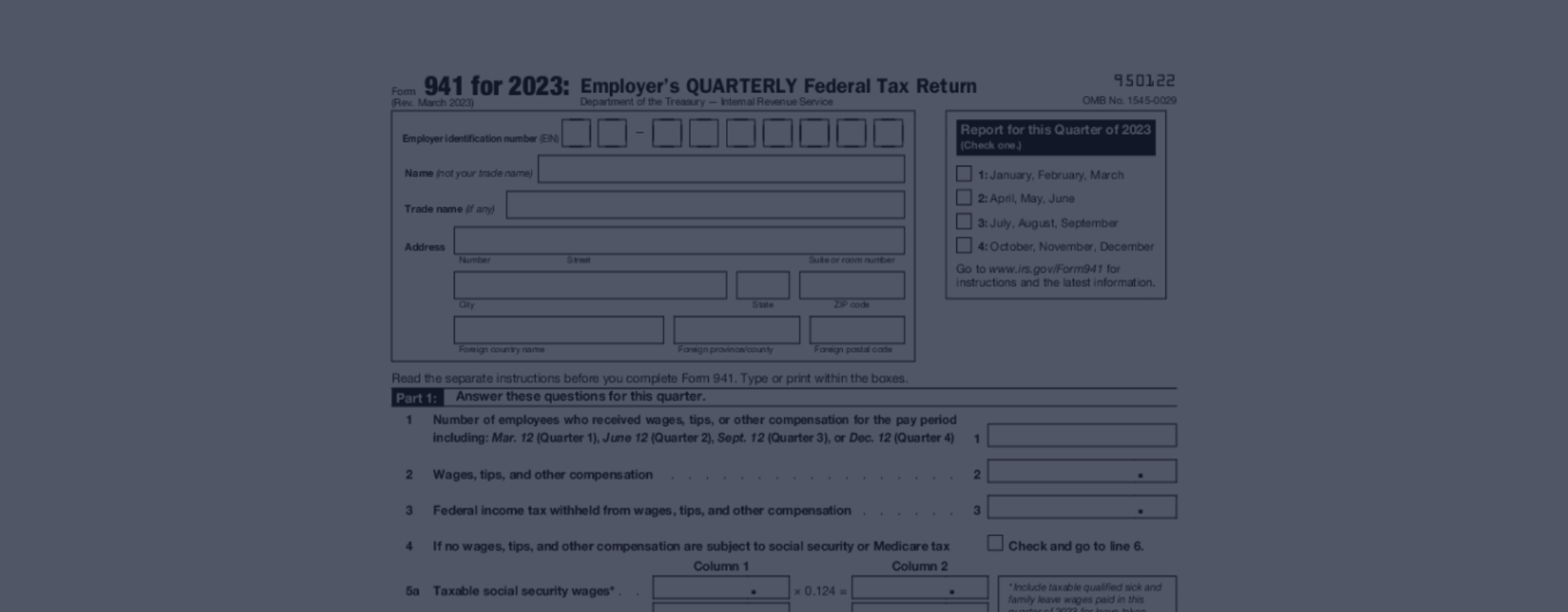

Blank IRS Form 941 for 2023

Get FormFilling Out Blank 941 Quarterly Form with Ease

- Locating and accurately recording the Employer Identification Number (EIN) is a primary step in filling out any federal 941 quarterly form for 2023. The EIN is a unique identifier for your business and must be noted without error on each quarterly submission.

- Another critical component of the IRS Form 941 for 2023 in PDF involves accurately detailing employee information. This includes reporting the correct number of employees, their wages, and any other compensation with precision. Even seemingly minor miscalculations can lead to an inaccurate tax liability, potentially causing significant headaches down the line.

- Now, let’s turn our attention to the specificities of compensation reporting. Taxable Medicare and Social Security tips must be calculated carefully to ensure full compliance with the corresponding taxation requirements. Similarly, any non-cash payments, such as fringe benefits or bonuses, must also be documented accurately within the form.

Federal Form 941: Tax Credits & Refunds

The 941 employee tax form also allows employers to apply for tax-related credits and refunds. For example, credits from the Employer Retention Credit can provide relief to businesses by reducing the total tax owed. It is paramount to understand the qualifications for such incentives and correctly claim them on your submission.

e-File Form 941

Electronic filing presents a solution to many common filing errors. When you file quarterly 941 form online, built-in checks help flag discrepancies before submission. Employers looking to harness this advantage can file the 941 quarterly report electronically, leveraging software designed for this purpose that may also help in storing digital records for future reference.

Fill FormAvoid Common Errors on Form 941 for 2023

While filing this form is a straightforward process for some, others may stumble upon common errors and pitfalls. Incorrect calculations, omissions of necessary information, or failure to provide a comprehensive report of all compensations and withholdings are frequent mistakes that can be mitigated by double-checking entries and adhering to the instructions for 2023 Form 941.

941 Payroll Tax Return: Frequently Asked Questions

- Where can I get the blank 941 quarterly form?For those still preferring paper submissions, acquiring a printable 941 quarterly form for 2023 is simple. It is possible to print free 941 quarterly form from our website.

- What is the 941 form example used for?Filers may seek to review a completed 941 form example to understand how to properly fill out their document. By examining these examples, employers can familiarize themselves with each section and minimize errors in their filings.

- What are the ways to file the 941 copy?There remains the option to file Form 941 to the IRS in person or via mail. Employers who choose this traditional method must ensure they have access to a free IRS 941 form, available for download and print.

- What is the most important about the 941 filling?Whether an employer chooses to fill out the 941 quarterly form, file online, or submit a paper copy, being informed is key. Correctly understanding and utilizing the digital federal form 941 in PDF format can save precious time and prevent mistakes.

IRS Form 941 Instructions for the 2023 Tax Year

Printable 941 Tax Form Before delving into the nitty-gritty of the IRS 941 form printable, it is essential to comprehend the basic format and major sections found in this tax return. This quarterly report document, also known as Employer's QUARTERLY Federal Tax Return, is utilized by employers to report income taxes, soci...

Printable 941 Tax Form Before delving into the nitty-gritty of the IRS 941 form printable, it is essential to comprehend the basic format and major sections found in this tax return. This quarterly report document, also known as Employer's QUARTERLY Federal Tax Return, is utilized by employers to report income taxes, soci... - 25 September, 2023

- Form 941 to File Online Form 941, titled Employer's Quarterly Federal Tax Return, is a crucial document for employers as it assists them in detailing the federal withholdings from their employees' paychecks. With the advent of digital technology, businesses now have the potential to fill out Form 941 online, thereby making...

- 22 September, 2023

- Federal 941 Form for 2023 Form 941, also known as 'Employer’s Quarterly Federal Tax Return,' is a crucial document introduced by the Internal Revenue Service (IRS). This form is designed to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and pay the employer's portion of soc...

- 21 September, 2023

Please Note

This website (941-quarterly-form.net) is an independent platform dedicated to providing information and resources specifically about the 941 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.