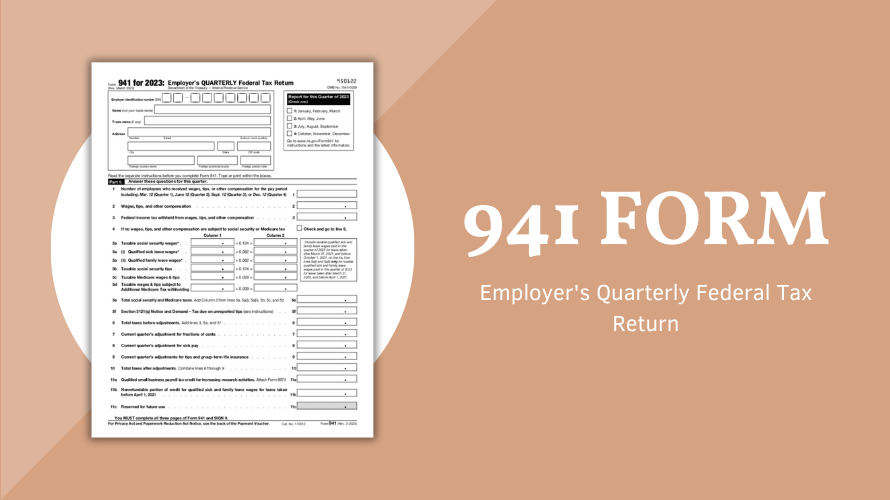

Federal 941 Form for 2023

- 21 September 2023

Form 941, also known as 'Employer’s Quarterly Federal Tax Return,' is a crucial document introduced by the Internal Revenue Service (IRS). This form is designed to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and pay the employer's portion of social security or Medicare tax.

Significant Changes to the Federal 941 Form for 2023

In the current fiscal year, the IRS has made several significant adjustments to the federal 941 form for 2023. They aim to adjust the tax rate depending on the updated tax laws and regulations. The IRS encourages taxpayers to actively monitor these changes to be aware of the new rules.

Federal 941 Form & Obligated Employers

It is important to remember that the federal 941 form is used by employers who pay remuneration for services performed by employees, including noncash payments. However, no tax is deducted or withheld upon notes or debts issued as remuneration, except in certain cases identified by the IRS. Some entities, like sole traders and limited liability businesses, can also benefit from this form. However, there are restrictions on its usage due to different tax reporting obligations among various businesses.

941 Federal Tax Form: Key Takeaways

For businesses, it is crucial to optimize tax responsibilities and take full advantage of the provisions in the 941 federal tax form.

-

First, ensure that you keep precise payroll records. This will prevent any mismatches that may occur when reporting the withheld taxes to the IRS.

-

Stay abreast of the deadlines to avoid penalties for late filing.

-

In case your business undergoes any structural changes, ensure you engage a professional tax consultant to understand the implications of your tax reporting obligations.

-

In case of difficulties in paying the total tax liability, consider enrolling for the installment agreement with the IRS. This will provide a structured payment plan.

Finally, your level of compliance on the federal quarterly 941 form will save your business from unnecessary penalties and ensure smooth operations by catering to the employee's welfare. Always stay informed about the latest tax guidelines and filing procedures remitted by the IRS on their official platform.

IRS 941 Tax Form: Answering Your Questions

- Who needs to file IRS Form 941?

It's specifically designed for employers. They must report the employer's portion of social security or Medicare tax. This applies to all employers in general, though there are exceptions for some government entities and seasonal businesses. - When is the due date to file Form 941?

It must be submitted before the last day of the month that follows the end of the quarter.- Quarter 1 (January, February, March) is due by April 30.

- Quarter 2 (April, May, June) is due by July 31.

- Quarter 3 (July, August, September) is due by October 31.

- Quarter 4 (October, November, December) is due by January 31.

- What happens if you file Form 941 late?

Typically, the IRS imposes a penalty of 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. If payment is not made with federal tax form 941, there's an additional penalty of 0.5% of the amount of tax. Extensions can be granted upon request, but it is advisable to adhere to the deadline to avoid potential penalties.