Form 941 to File Online

- 22 September 2023

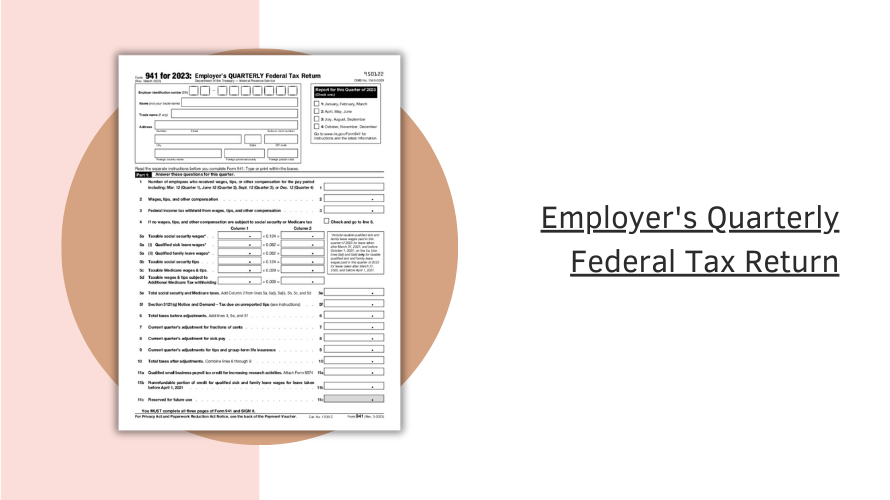

Form 941, titled Employer's Quarterly Federal Tax Return, is a crucial document for employers as it assists them in detailing the federal withholdings from their employees' paychecks. With the advent of digital technology, businesses now have the potential to fill out Form 941 online, thereby making the process more streamlined and efficient. Our comprehensive guide below is all set to provide you with an understanding of this pivotal form and simplify the online filing process.

The Features of Fillable Online 941 Form

Form 941 for online filing has many distinctive features that significantly enhance its functionality. This fillable form has been meticulously designed to ensure usability. Numerous sections are compact and properly labeled, providing concise instructions to help you navigate through the sea of financial terminologies and tax obligations. Storing and retrieving data becomes noticeably easier, all thanks to the multiple-choice fields and drop-down menus. Furthermore, the data entered in these forms is accurately fetched by the system for future reference, minimizing the chances of errors.

Common Difficulties with Online Filing

Despite abundant benefits, certain complexities are often associated when you file the 941 quarterly online. However, most of these difficulties are due to a lack of familiarity with the system or the failure to observe certain rules. Some taxpayers struggle with the exact calculation of their quarterly tax liabilities, while others grapple with the right information to put in specific sections. Often, errors occur while filling out precise dates and entering payment details. It's vital to understand these challenges to continue taking advantage of the digitalization of the 941 tax filing process.

Key Rules to Complete Form 941 Online

To successfully complete your IRS Form 941 and file online, here are some important rules to consider:

- Always double-check the information you input. Any mistake in filling out the form can lead to a delay in the processing

- Keep track of the dates you input each quarter. Indicating the incorrect quarter might result in a filing error

- Ensure you have all the necessary data ready before starting. This includes employee data, your EIN (Employer Identification Number), and accurate calculations for the quarter's withholding taxes

- Once you're done filling out Form 941 online, take the time to review everything from top to bottom. Break down each section to see if everything squares away properly

Remember, proper and timely filing of your Form 941 protects your business from penalties and late fees. So why wait for the deadline rush? Start taking advantage of online filing now.