Printable 941 Tax Form

- 25 September 2023

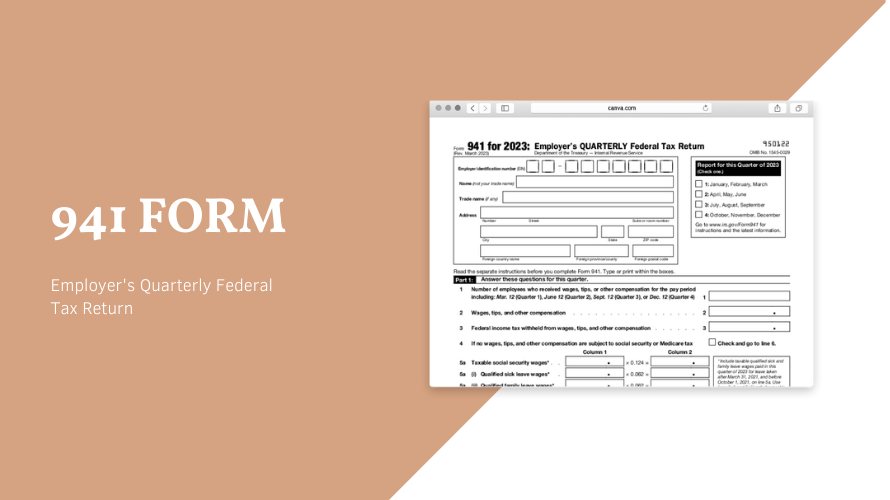

Before delving into the nitty-gritty of the IRS 941 form printable, it is essential to comprehend the basic format and major sections found in this tax return. This quarterly report document, also known as Employer's QUARTERLY Federal Tax Return, is utilized by employers to report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Additionally, it is used to pay the employer's portion of Social Security or Medicare tax.

The printable 941 tax form is divided into five parts:

- Part 1 requires information on the number of employees, the total payroll for the quarter, and the taxes withheld from the payroll.

- Part 2 requests additional information if your business has closed or you're a seasonal employer.

- Part 3 regards the tax liability for each month of the quarter, whereas Part 4 needs your signature and title.

- The final section of the printable Form 941, Part 5, is only required for third-party designees.

Printable 941 Form: Step-by-Step Filling Guide

To successfully complete the printable 941 form for 2023, be sure to adhere to the following steps:

- Accurately report the total number of employees you have paid.

- Double-check to ensure the total wages, tips, and other compensation are correctly calculated.

- Ensure to determine the correct withheld federal income tax amount.

- Appropriately calculate the taxable Social Security and Medicare wages and tips.

- For any adjustments, be sure to use lines 7 through 9.

- Compute the total taxes after adjustments and credits.

- Lastly, sign and date Form 941.

Guide to Filing the 941 Tax Form

After correctly filling out the IRS tax form 941 printable, the next step involves submitting it to the Internal Revenue Service. Note that the filing method depends on specific characteristics of your business, such as size and location. A majority of employers file their tax forms electronically. However, if you opt for a printed version, make sure you mail it to the IRS address listed for your state. Ensure to attach a payment voucher if you are mailing a payment.

Submitting IRS Form 941

Each quarter of the year has a distinct deadline to submit Form 941. The due date typically falls on the last day of the month that follows the end of the quarter. For instance, the deadline for the first quarter (January to March) is April 30th. Remember, late submissions are subject to penalties and interests. Always keep an eye out for exact deadlines and changes.